How Long to Mine 1 Bitcoin in 2021?

The Bitcoin Network clearly demonstrates the power of financial incentives on human behaviour.

The distribution of incentives by the Bitcoin Network, presented as rewards for solving cryptographic puzzles, is clearly aligned with the requirements of the network which are: network security, validation of transactions and “Double-Spend” prevention. The Bitcoin Network’s 99.985% uptime reveals that individuals and groups respond positively to incentives presented as rewards.

At the moment, said reward for contributing to the security of the network and for validating transactions, as well as for adding them to new blocks (generated every 10 minutes), is 6.25 Bitcoins (BTC). This reward is significantly lower than in the past: when bitcoin was first introduced to the world, Satoshi Nakamoto set the block reward at 50 Bitcoin. In 2012, this reward was halved to 25 Bitcoins. In 2016, it halved again to 12.5 BTC. As of February of this year, miners are gifted 6.25 Bitcoins for every block they mine, which in Dollars is worth $233,225.00.

Given the price of Bitcoin, and the current block reward, many of our readers with hardware to spare might be wondering if it is worth their while to mine Bitcoin for a profit.

While it is certainly possible to mine Bitcoin for a profit, determining how much money can be made and how long it would take one to become profitable and mine 1 bitcoin depends on a lengthy set of parameters which we will examine below.

What type of Mining are we talking about exactly?

The first parameter we need to examine is: what type of mining are we talking about exactly?

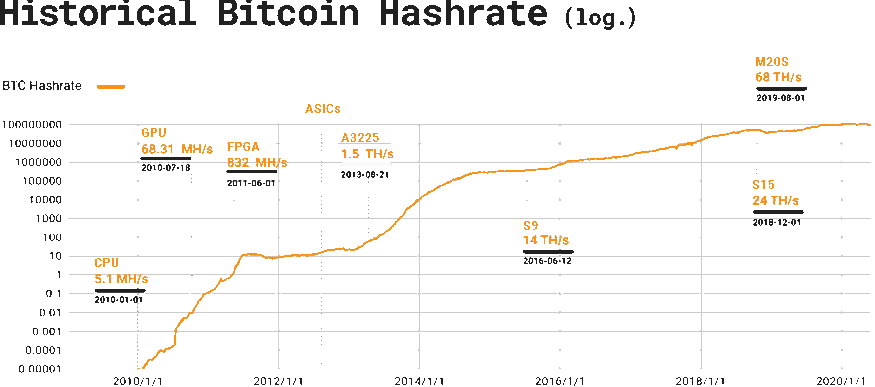

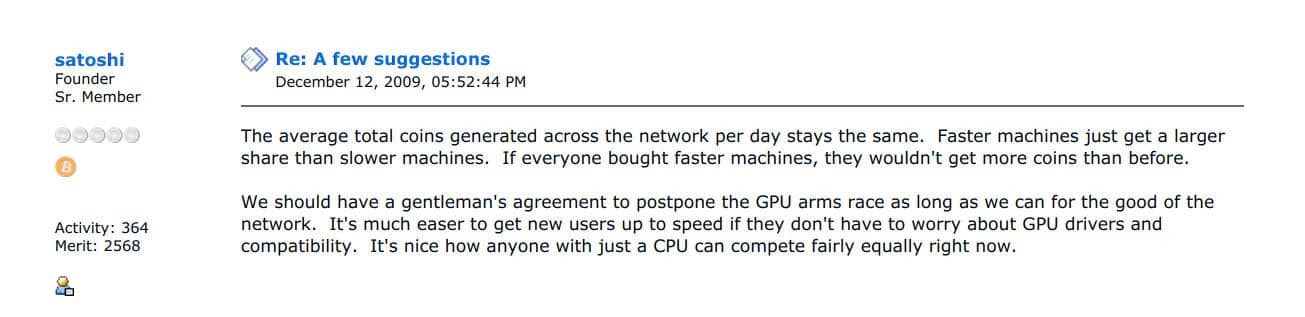

It was possible to engage in CPU mining in the old days: mining difficulty was set so low that individuals could make a profit with a laptop equipped with a mid-range GPU or a multi-core CPU. However, CPU mining does not make sense today.

Nowadays, individuals and organizations across the globe engage either in GPU or ASIC mining. Difficulty today requires powerful machines and sufficient hashrate in order to generate new blocks.

Why does mining require powerful mining equipment and ever increasing hashrate (a measure of a Bitcoin Mining rig’s computational power)? What are miners doing or solving exactly?

What miners do is guess a target hash by generating at high speeds a nonce (32 bits in size). The first miner who guesses a nonce whose hash is less or equal to the target hash wins the prize which is currently set at 6.25 BTC per block. Miners are engaged in a global race to guess this hash, and only one miner (or group of miners, in the case of mining pools) can be awarded the prize.

The choice of Software is Crucial

Mining has arrived at the era of hyper-choice: there is a plethora of software options for miners. Each software solution has its own pros and cons but the important thing is that miners should choose software they can configure in order to maximize their hardware’s hashrate. Let us review three of these options.

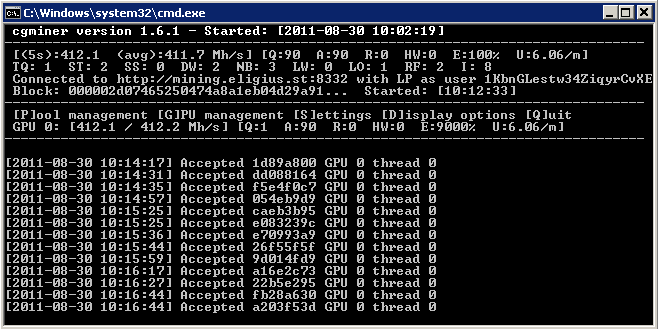

CG Miner, launched in 2011, is one of the oldest software solutions available for Bitcoin miners. It is open-source, and its ability to run on any computer and mining hardware has made it a popular option. CG Miner has a sterling reputation as it is viewed as the best bitcoin mining software out there, due to its simplicity and cross-platform compatibility. It uses a simple command line interface that allows remote monitoring and command of rigs.

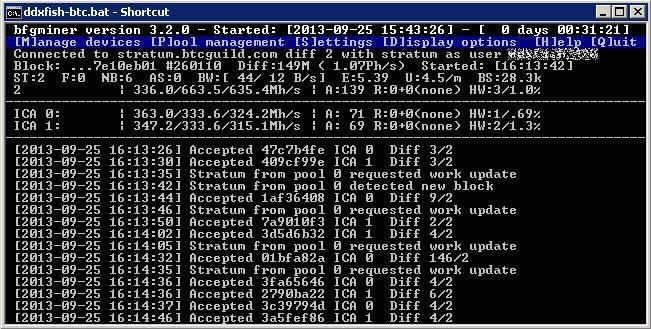

BFG Miner is another popular option. Capable of mining multiple cryptocurrencies, it allows advanced users to tweak their mining process, with dynamic clocking, monitoring and remote mining capabilities.

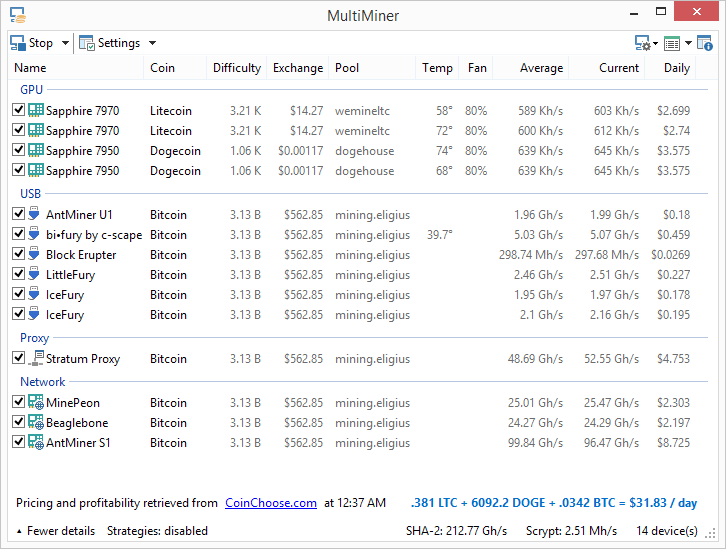

Multiminer, developed in 2013 by a BFG miner dev using the exact same engine, is clearly the best choice for beginners. It has a GUI instead of a command Line interface, sports automated hardware detection and numerous mining features, and is cross-platform compatible. The software shows users how to connect to a mining pool including where to input the information associated with the pool. It will automatically mine the most profitable and lowest difficulty coin while displaying estimated profits.

Solo Mining and Pool Mining

The next parameter we need to examine is: how is the Bitcoin being mined, solo or within a pool? While any rational miner would be tempted to maximize the reward by mining alone, the probability of a solo miner obtaining the block reward is extremely low.

A solo miner that contributes (let us say it: an unlikely) 1% of the total hash rate of a gigantic pool such as F2Pool (F2Pool is currently contributing around 26.73 EH/s of the total Bitcoin hash rate of 134.6 EH/s, or 19% of the global hash rate!) would earn approximately 1.79 BTC per day.

A miner would need close to 149.2 PH/s of hash rate to mine this amount of BTC per day at the current difficulty level, which is readjusted every 2016 blocks (approximately two weeks). This solo miner would need to run 2,331 of the latest 64 Terahash per second Antminer S17e ASIC miners. This setup would cost this miner hundreds of thousands of dollars.

The cost of solo mining is clearly redhibitory.

It makes much better business sense to work as a part and parcel of a mining pool, in order to share the risks and rewards. A mining pool brings together miners across the globe. The computational power or hashrate of individual miners is combined and set to target an individual block. Mining pools obviously have an advantage against solo miners as the game favors the entities with the most hashrate:

It is incredibly important to pay attention to the small print when selecting a mining pool - they all come with specific mining payout schemes and fees.

The Cost of Electricity

The cost of electricity can make or break a bitcoin mining operation. It makes excellent business sense to establish or move operations, in order to lower Operational Expenses, in countries where power is abundant and cheap. At the lower end we find countries such as Trinidad and Tobago, Kuwait, Belarus and Bangladesh. At the higher end we find countries such as Belgium, Cook Islands, Marshall islands, and South Korea.

Evaluating how long it would take to mine 1 Bitcoin

As we have seen above, determining how long it would take to mine 1 bitcoin depends on a host of parameters such as: hardware, software, type of mining, and costs such as electricity. We did not even mention important parameters such as market sentiment, mining fleet maintenance costs and so on!

However to get a rough idea of how long it would take it is advised to “plug in” arbitrary values in Bitcoin profitability calculators, which will return a value based on inputs such as computing power or hashrate, electricity cost, etc.

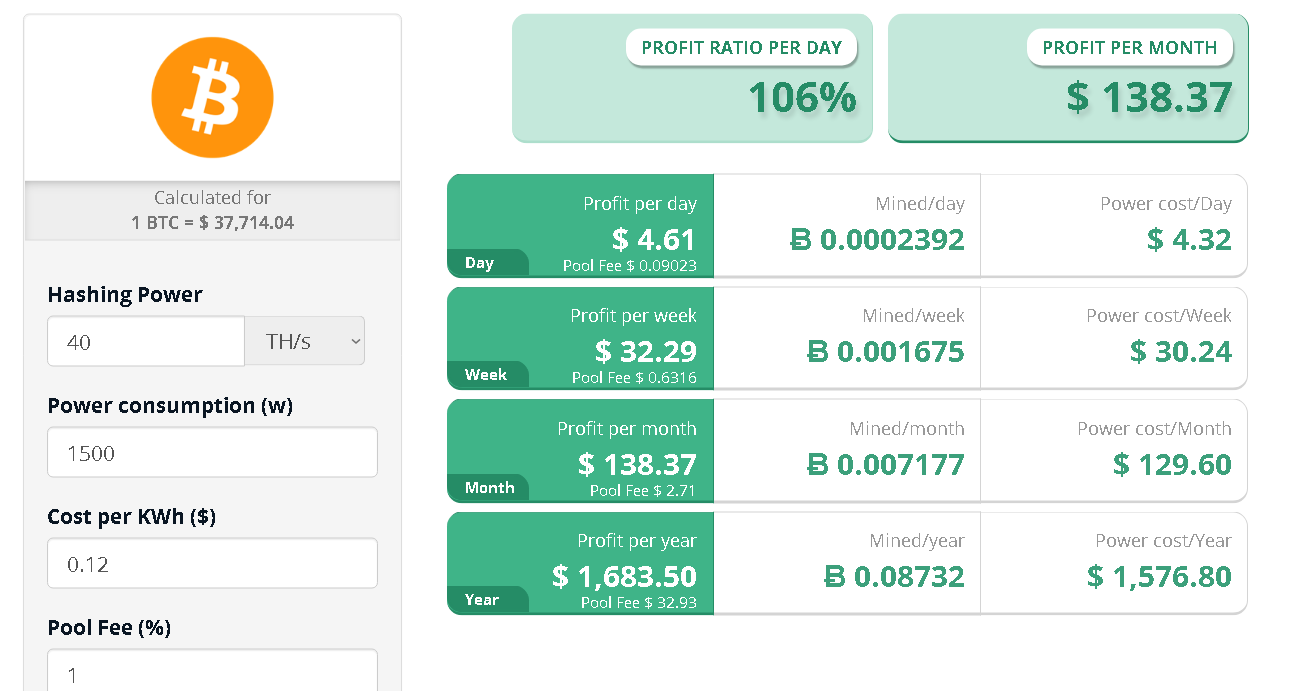

Using CryptoCompare’s profitability calculator, we input the values below and find that our profit per day, with a mining rig producing 40 TH/s, is 4.61$ a day, 32.29$ a week, 138.37$ a month and 1683$.50 a year.

While profitability calculators do not account for all parameters and Black Swan events such as the March 2020 selloff, it should give you a rough idea of what to expect.